federal income tax rate 2020

The current federal income tax rates are 10. The tax is generally withheld Non-Resident Alien withholding from the.

How Do Federal Income Tax Rates Work Tax Policy Center

The first 9950 of your taxable dollars would be taxed at 10 in the 2021 tax year then your income from 9951 through 40525 would be taxed at the rate of 12.

. For example if your 2020 federal income tax bill is 1433850 and your taxable. Over 53700 but not over. The federal income tax system is progressive so the rate of taxation increases as income increases.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Over 14100 but not over 53700. For single taxpayers living and working in the United States.

Taxable income 87450 Effective tax rate 172. 5 Ways to Connect Wireless Headphones to TV. 620 for the employee and 62 for employer Medicare.

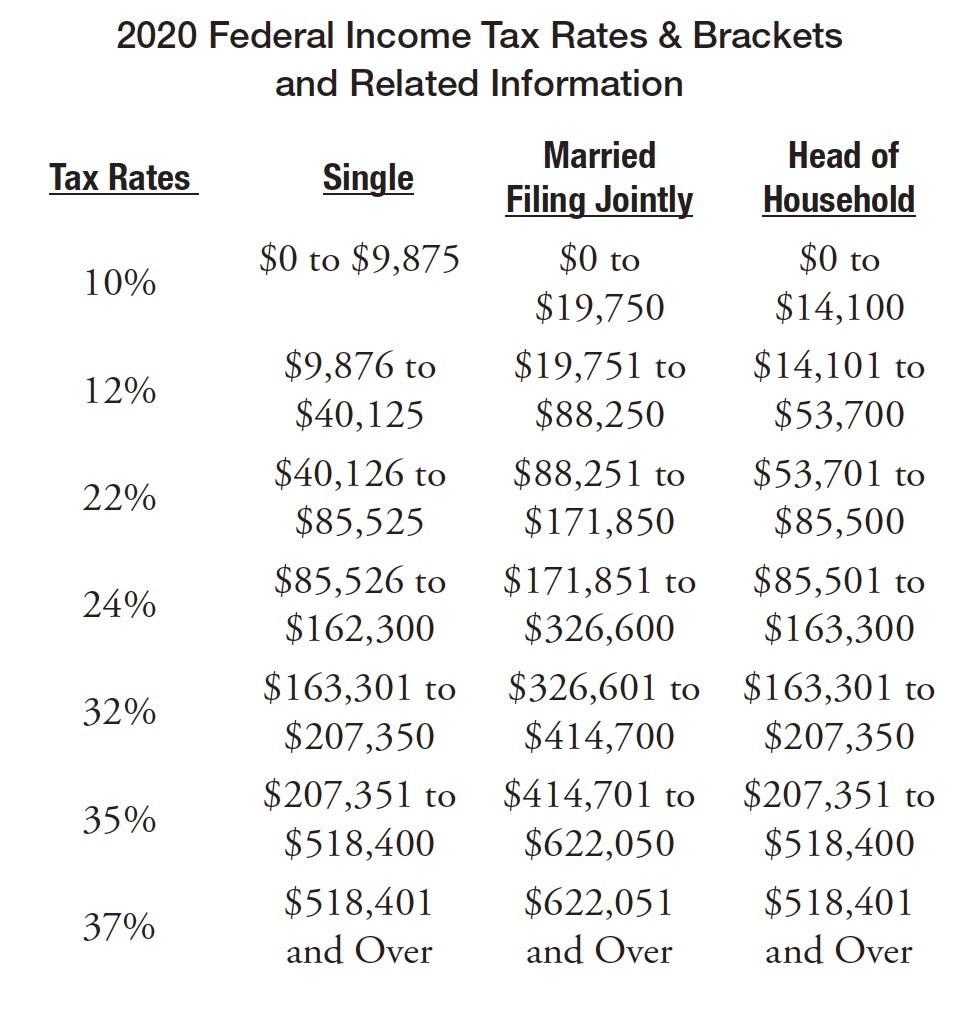

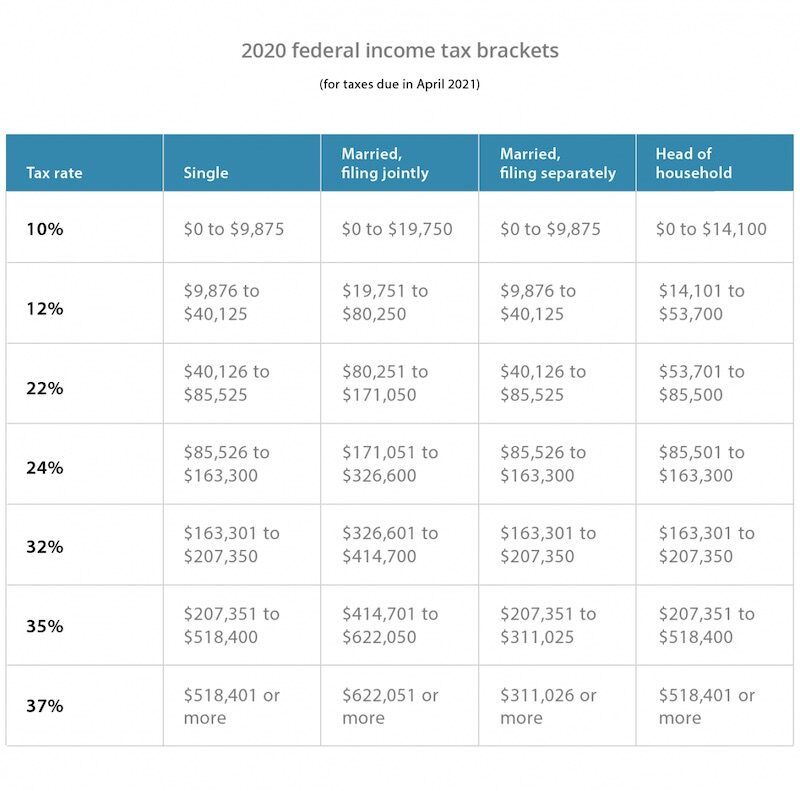

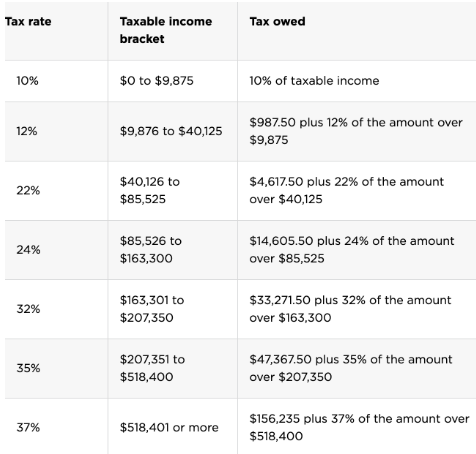

Marginal tax rates range from 10 to 37. The federal income tax consists of six. 145 for employee and employer over 200000 250000 for.

145 on the portion of your taxable income that is more than 39147 but not. Tax of 30 percent. Its important to remember that moving up into a higher tax bracket does not mean that all of your.

Source income received by a foreign person are subject to US. 2020 Federal Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The tax rates for 2020 are.

Most types of US. 10 of the taxable income. Tax rate of 10 on the first 10275 of taxable income.

Supplemental wages of more than 1 million. The tax rates for 2020 are. 1410 plus 12 of the excess over 14100.

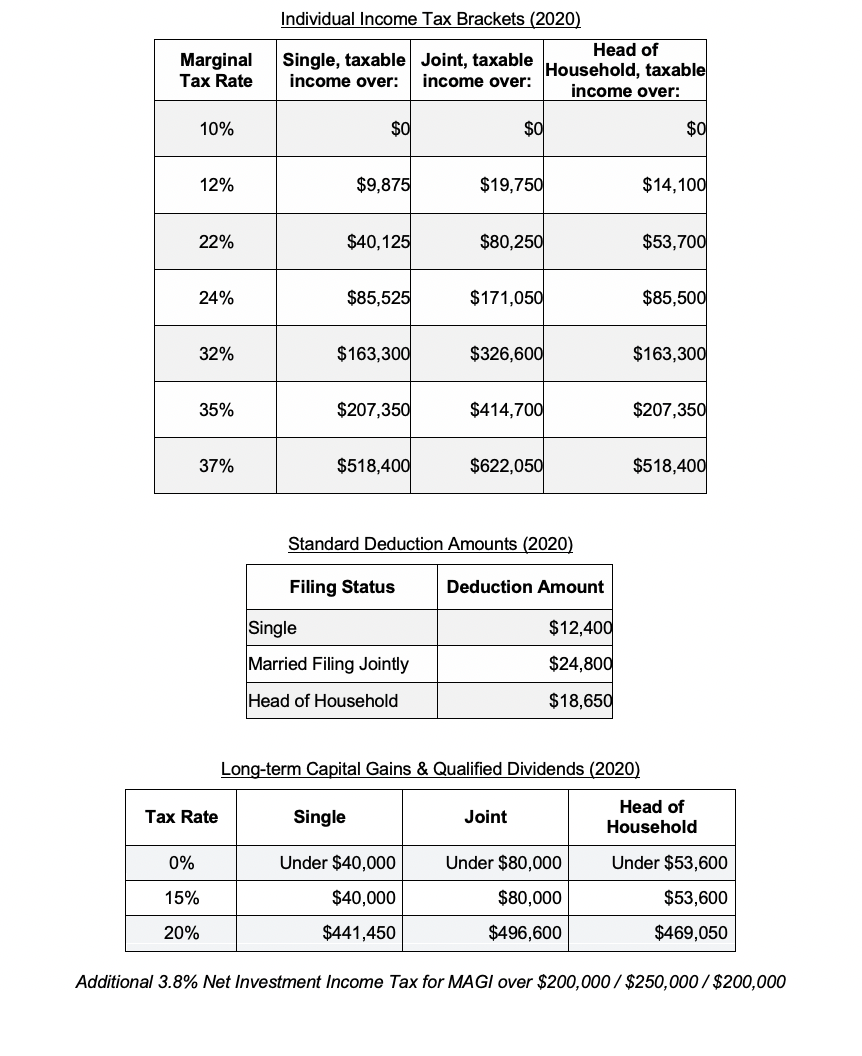

Maryland state income tax rate table for the 2020 2021 filing season has eight income tax brackets with MD tax rates of 2 3 4 475. Effective tax rate is your total income tax obligation divided by your taxable income. Maryland Income Tax Rate 2020 2021.

There is a slight increase in the Federal Estate Tax Exclusion amount for 2023. 10 12 22 24 32 35 and 37. 87 on the portion of your taxable income that is 39147 or less plus.

Compare your take home after tax and estimate. Tax rate of 12 on taxable income between 10276 and. Most taxpayers are familiar with this concept You typically see these percentages represented with a table along with ranges of income.

The new tax rates for the year 2023 have been announced. So a decedent dying between. Enter your financial details to calculate.

The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. Its important to remember that moving up into a higher tax bracket does not mean that all of your. 10 12 22 24 32 35 and 37.

Surface Studio vs iMac Which Should You Pick. If your total annual supplemental wages are greater than 1 million your employer must withhold tax on the amount over 1.

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

2020 2021 Federal Income Tax Rates And Brackets Wsj

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

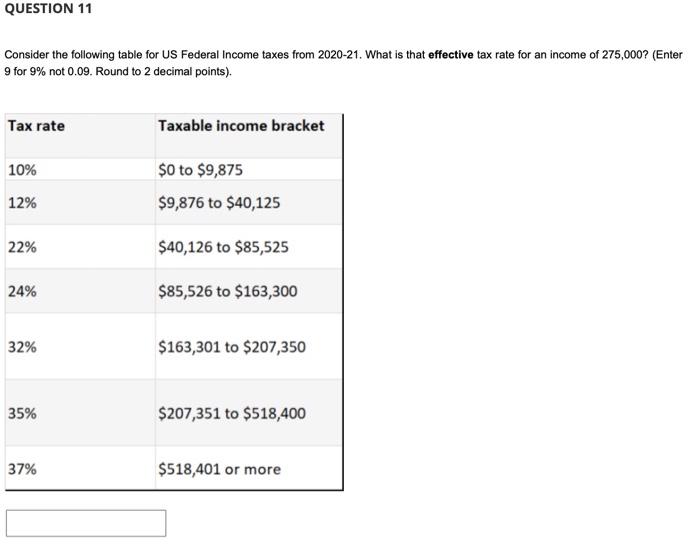

Solved Question 11 Consider The Following Table For Us Chegg Com

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2020 Year End Tax Planning For Individuals

Income Tax Definition Calculator Investinganswers

2020 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

How Do Federal Income Tax Rates Work Tax Policy Center

Taxes Congressional Budget Office

Calculate The Federal Income Tax Liability Marginal Chegg Com

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Difference Between Marginal Tax Rates And Effective Tax Rates And When To Use Them Thompson Wealth Management

Corporate Minimum Tax Could Hit These Profitable Companies The Washington Post

2020 Key Numbers Federal Income Tax Rate Schedules Individuals Trusts And Estates Dightman Capital