is interest on your car loan tax deductible

So if you drive your car 50000 miles and 25000 of these miles are for. Typically deducting car loan interest is not allowed.

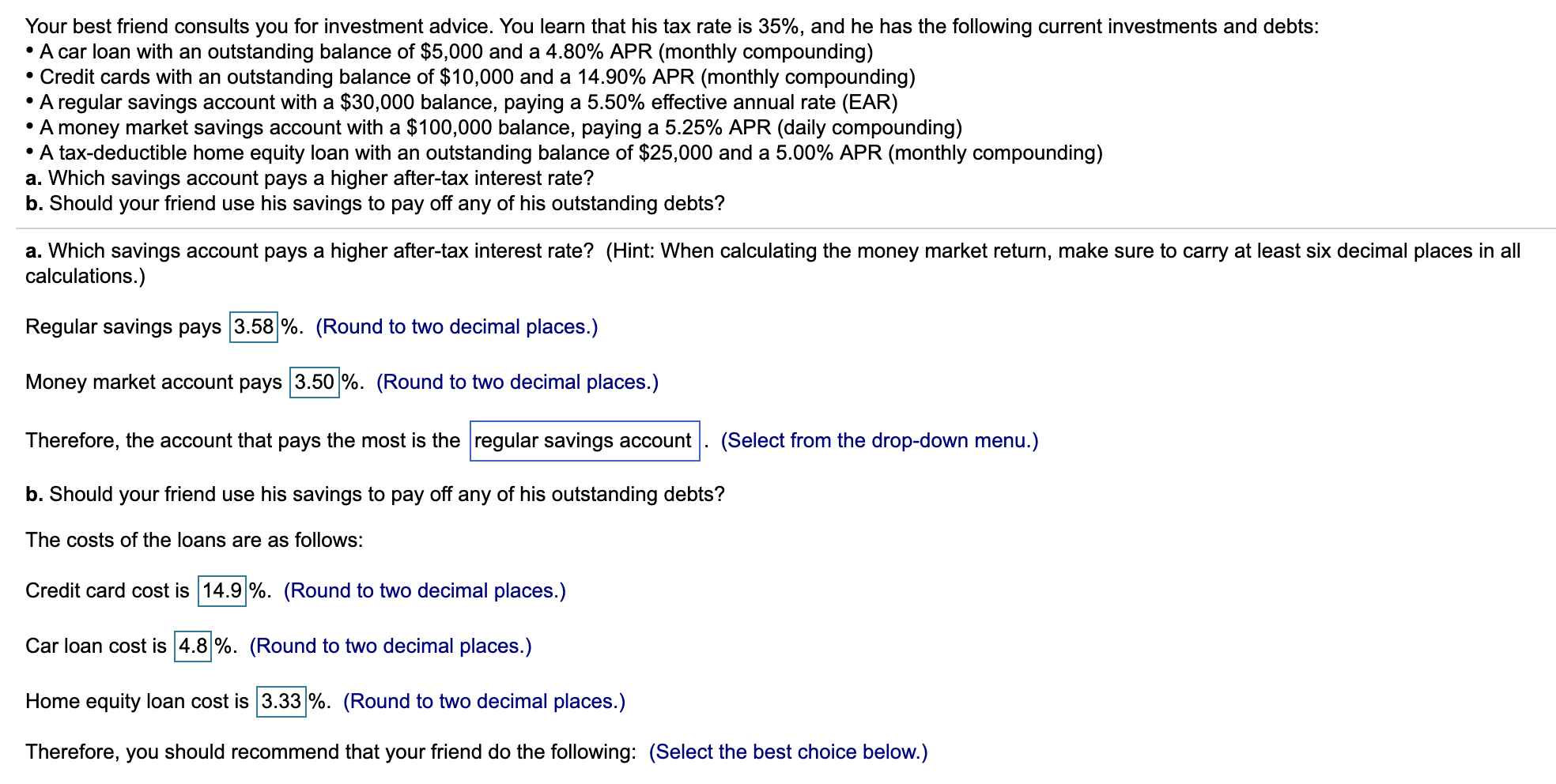

Your Best Friend Consults You For Investment Advice Chegg Com

To do this you have to keep detailed records of these expenses and the miles you drive for business.

. Should you use your car for work and youre an employee you cant write off any of the interest you pay on. For example if youre self-employed and you use. However for commercial car vehicle and.

You cannot deduct the actual car operating costs if you choose the standard mileage rate. Unfortunately car loan interest isnt deductible for all taxpayers. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation. 50 of your cars use is for business and 50 is personal. The IRS allows you to deduct the interest you pay on a loan for your car provided the vehicle is used for business purposes.

But there is one exception to this rule. This is why you need to list your vehicle as a business expense if you wish to deduct the interest. The interest you pay on student loans and mortgage loans is tax-deductible.

You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions. There are a few other scenarios in which you might be able to deduct car loan interest on your taxes but theyre very rare. The loan can be a first or second mortgage home.

In order to deduct the interest you must itemize. If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes. Experts agree that auto loan interest charges arent inherently deductible.

Interest on loans is deductible under CRA-approved allowable motor vehicle. Mortgage Interest Deduction. Car loan interest is tax deductible if its a business vehicle.

Mortgage interest on your home is deductible when you itemize deductions on your tax return. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest. When you file your taxes with the Internal.

Reporting the interest from these loans as a tax deduction is fairly straightforward. This is why you need to list your vehicle as a business expense if you wish to deduct the interest. This means that if you pay 1000.

The standard mileage rate already. History of the 60L Power Stroke Diesel Engine. Is interest on your car loan tax deductible.

Car loan interest is tax deductible if its a business vehicle. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. May 10 2018.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as. Interest on car loans may be deductible if you use the car to help you earn income.

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

Are Mortgage Payments Tax Deductible Taxact Blog

25 Small Business Tax Deduction You Should Know In 2022

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

How To Write Off Vehicle Payments As A Business Expense

Can I Write Off My Car Payment

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Your 1098 E And Your Student Loan Tax Information

16 Amazing Tax Deductions For Independent Contractors Next

Are Personal Loans Tax Deductible Common Faqs

Is The Interest You Paid On A Personal Loan Tax Deductible

Are Medical Expenses Tax Deductible

Most Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

What The New Tax Law Will Do To Your Mortgage Interest Deduction Marketwatch

Tax Deduction For Business Use Of Your Personal Vehicle Googobits

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

How To Calculate Interest On A Car Loan Car Loan Interest Rate Auffenberg Dealer Group

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

How Home Equity Loan Interest Tax Deduction Works

17 Big Tax Deductions Write Offs For Businesses Bench Accounting